As our world becomes increasingly connected, satellite communication companies are taking center stage in bridging the digital divide.

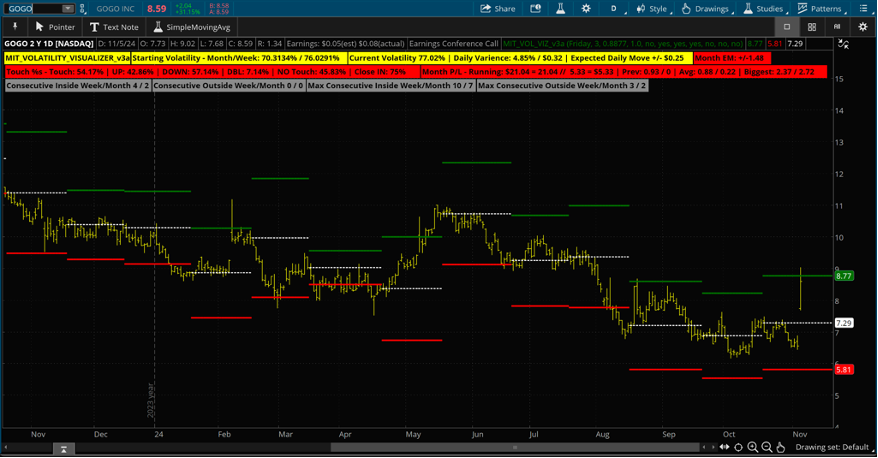

Today’s market action highlights the volatility in this space. Recently, one major satellite player, Gogo Inc. (NASDAQ: GOGO), surged an impressive 31% in a single trading session, underscoring the potential for dramatic moves in these stocks.

This remarkable single-day gain for GOGO clearly demonstrates the dynamic nature of the satellite communication sector and the potential for significant price swings. Such volatility can offer exciting opportunities for traders… However, it also emphasizes the importance of careful risk management and thorough research.

In this article, I’ll examine seven key players in this exciting sector, offering insights for retail traders looking to explore these high-tech opportunities. So let’s break down some key metrics to help you better understand these companies…

Understanding the Key Metrics

Before we dive into the companies, let’s break down two important terms that will help you assess these stocks:

- Beta: This measures a stock’s volatility compared to the overall market. A beta of 1.0 means the stock moves in line with the market. Higher than 1.0 indicates more volatility (potentially, higher risk and reward), while lower than 1.0 suggests less volatility.

- Implied Volatility (IV): This reflects the market’s expectation of a stock’s future volatility, derived from options prices. Higher IV suggests traders expect more price swings, which often correlates with higher options premiums.

The Satellite Seven: A Closer Look

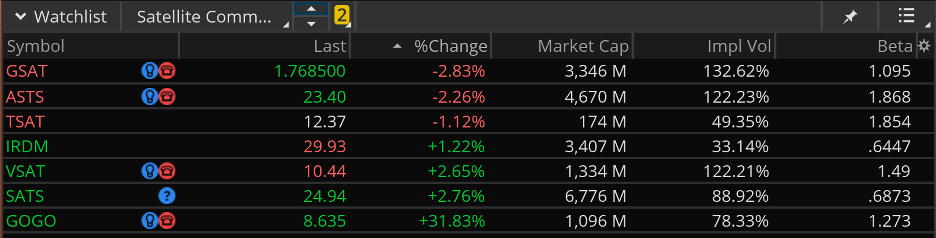

- Globalstar, Inc. (NYSE: GSAT)

- Market Cap: $3.346 billion

- Implied Volatility: 132% (Highest in the group)

- Known for: Mobile satellite services and Apple partnership

- AST SpaceMobile (NASDAQ: ASTS)

- Beta: Over 1.8 (Indicating high volatility)

- Known for: Pioneering space-based cellular broadband

- Iridium Communications (NASDAQ: IRDM)

- Implied Volatility: 33% (Lowest in the group)

- Beta: Under 0.7 (Suggesting lower volatility)

- Known for: Operating world’s largest commercial satellite constellation

- EchoStar Corporation (NASDAQ: SATS)

- Beta: Under 0.7 (Indicating lower volatility)

- Known for: Providing global satellite communication solutions

- Viasat, Inc. (NASDAQ: VSAT)

- Market Cap: $2.27 billion

- Known for: High-speed satellite broadband and secure networking

- Telesat Corporation (NASDAQ: TSAT)

- Beta: Over 1.8 (Suggesting high volatility)

- Known for: Planning low Earth orbit (LEO) constellation

- Gogo Inc. (NASDAQ: GOGO)

- Known for: Engineering in-flight connectivity and wireless entertainment services

What This Data Tells Us

- Volatility Spectrum: GSAT’s high implied volatility (132%) suggests traders expect significant price movements, potentially offering opportunities for options strategies. In contrast, IRDM’s lower IV (33%) might indicate a more stable price outlook.

- Market Sensitivity: ASTS and TSAT, with betas over 1.8, are likely to amplify broader market movements. This could mean bigger gains in bull markets but also steeper drops in downturns. IRDM and SATS, with betas under 0.7, might offer more stability, potentially moving less dramatically with market swings.

- Risk and Reward Balance: Higher beta stocks like ASTS and TSAT could offer greater potential returns but with increased risk. Lower beta stocks like IRDM and SATS might be considered for more conservative positions in a diversified portfolio.

Trading Implications

- Options Traders: The high IV of GSAT could mean rich premiums for selling options, but be aware of the increased risk of significant price moves.

- Momentum Traders: Keep an eye on high-beta stocks like ASTS and TSAT for potential trending moves.

- Value Investors: Lower beta stocks like IRDM and SATS might offer steadier growth opportunities.

Industry Outlook

The satellite communication sector is poised for growth, driven by increasing demand for global connectivity, 5G integration, and expanding Internet of Things (IoT) applications. However, high capital requirements and regulatory challenges remain key considerations.

Expert Insight

For the latest analysis on these high-flying stocks and other market movers, tune into Masters in Trading LIVE with Jonathan Rose. With over 25 years of professional trading experience, Jonathan provides valuable insights for navigating this dynamic sector. Catch the show every morning at 11 AM EST to stay ahead of market trends.

Remember, while the satellite communication sector offers exciting potential, it’s crucial to conduct thorough research and consider your risk tolerance before investing. These stocks can be volatile, so proper position sizing and risk management are essential.

Thanks for reading,

Jonathan Rose