2025 has delivered some of the wildest market swings in history – and we’re only in May.

Yes, volatility has cooled a bit thanks to the 90-day tariff reprieve and a market searching for optimism amidst heightened fear and uncertainty.

But don’t be fooled…

Volatility isn’t going anywhere fast.

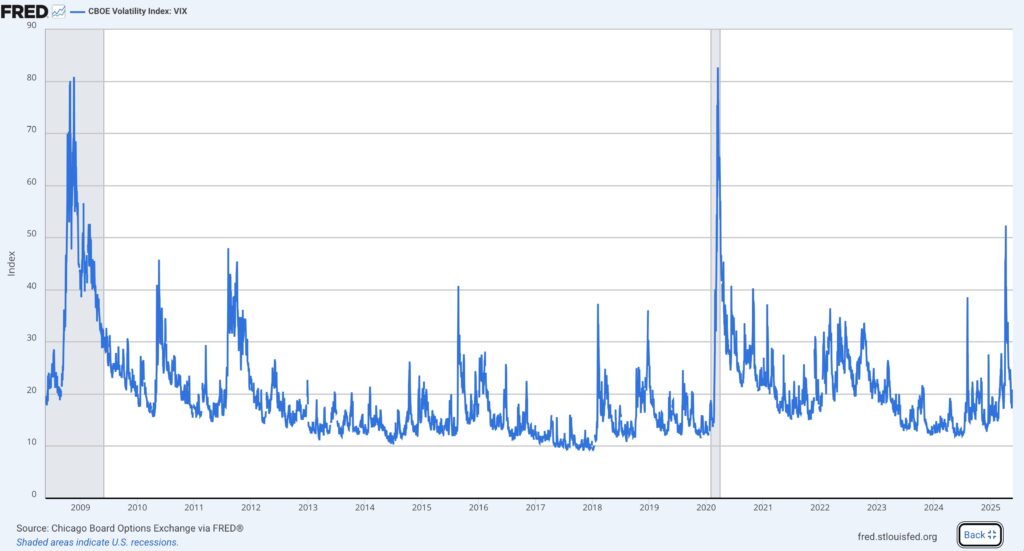

Just take a look at this VIX chart.

This chart gives us the clearest read on volatility imaginable.

When it spikes, markets are in panic mode. When it drops, investors breathe easier.

The April spike tells a sobering story. Over the past , the VIX has only climbed higher twice: during the 2020 Pandemic and the 2008 Financial Crisis.

While we’re down from April’s shocking highs, we’re not out of the woods just yet.

This isn’t a market for the faint-hearted.

But for nimble traders, all this volatility creates perfect trading opportunities – as long as we know where to find them.

While others panicked these past five months, we’ve leveraged one of the market’s most reliable catalysts to stay ahead of the chaos – and it’s helped us lock in serious gains.

The Market’s Most Consistent Catalyst

When companies report earnings, stock prices move – often dramatically.

And a positive beat can absolutely send the markets into overdrive…

Take Shopify (SHOP) in February…

Right as volatility sparked one of the worst market sell-offs of the year, we scored one of our biggest wins ever.

It was the perfect earnings play…

The online shopping giant reported an impressive earnings beat on February 11th that sent the stock soaring in mere days.

The good news included a 31% year-over-year revenue increase and record free cash flow of $1.6 billion for the whole year.

Those impressive Q4 results were enough to send the stock soaring over 8% within a few days.

Now, I knew Shopify’s massive performance was no fluke.

With a massive $130 billion market cap and steady growth propelling it, I already knew Shopify’s fundamentals were sound.

And after gapping up on its earnings beat in November, the stock had been climbing for months.

Shopify was one of the biggest growth stories of 2024. And even with volatility wreaking havoc on the stock market, the stock wasn’t about to lose steam.

Fortunately for us, we got into position even as the bulls started falling out of the markets.

I recommended a strategy that captured upside while limiting downside risk.

Volatility was still the name of the game. I didn’t want any of my readers to get burned in case the trade went sideways.

So how did we do?

We ended up with a total return of more than 117% after all was said and done. And we hit that return after holding the position for just 37 days.

That’s just one example of how a powerful earnings-based trading can be.

There are so many other big wins my strategy has helped us discover just in the last few weeks…

Like the massive 343% return I handed readers back in August one on option trade…

The huge 219% gain we just locked in on one bullish trade a few weeks ago…

And even the record-setting six earnings-driven wins we locked in back on May 13th.

All those gains have helped us keep skin in the game during one of the most volatile markets in history.

But success isn’t just about trading earnings. It’s all about understanding how to value volatility.

And that sort of intel has been my speciality for decades — and it forms the core of one most potent and repeatable strategies trader could have in their arsenal.

A Game Plan for Volatility

Whether it was my time on the Chicago Mercantile Exchange (CME) floor back in 1997 — known as the largest options and futures exchange in the world.

Or my time as an options market maker at the Chicago Board of Options Exchange (CBOE) helping the biggest hedge funds, investment banks, and institutional players profit in the options market…

Four times a year, you can depend on earnings to move markets.

The smart money knows this fact all too well.

And for decades, I guided institutional capital toward these big gains.

But I felt like I was missing something…

What about the regular day traders just trying to put their capital to work?

People like my friends and family. Many of whom generally wouldn’t have the first hint about some major, market-making bets in the options market.

I was only making the smart money richer. And that’s when it occurred to me…

Why not bring regular traders into the fold and teach them how to trade earnings like the smart money?

Once I jumped off the market-making bandwagon, a whole new world opened up to me…

Since leaving market-making, I’ve trained over 100 professional traders and guided more than 30,000 subscribers.

These are everyday people benefiting from the same low-risk, high-reward approach once reserved for Wall Street pros.

The key is tracking real money flow – not headlines, but the footprints institutional players leave behind.

This allows us to benefit from earnings while keeping risk manageable.

Even as one earnings season winds down, another is always just around the corner — and with markets hovering near key technical levels, now’s the perfect time to lock in an approach that keeps traders ready, responsive, and consistently one step ahead.

And that’s exactly what I focus on in my Earnings Advantage trading strategy.

So far, this earnings season has been very good to my readers. Just look for yourself…

PINS: +79.4%

ZIM: +17.39%

GSL: +67.86%

TPC: +119.17%

BAND: +18.05%

TASK: +72.4%

Six-for-six. No misses. Just winners.

That’s a 100% win rate and an average return of 62.35% since April — not over a year, not in a bull run, but right now in a choppy, uncertain market.

And I have even more trades in the pipeline before the current earnings season comes to a close.

I want you to be able to benefit from one of the most important earnings seasons in recent memory.

So today, I want to give you the opportunity to learn all about my earnings-based trading system. Just click here to learn more about my earnings-based trading strategy.

And if you want to see exactly how I spot these trades in real time, you can join me – for free – every weekday morning at 11 a.m. ET on Masters in Trading Live.

On these livestreams, you’ll get…

- A professional trader’s morning check-in

- Insights into what sectors are moving the market

- And real-time setups you can follow in your account

If you’re interested in learning how to trade like a pro… and profit from volatility with trades like these… sign up for free here.

Remember, the creative trader wins…

Jonathan Rose

Founder, Masters in Trading