The world is entering a transformative era in energy production—one that combines the resurgence of nuclear power with the rapidly expanding influence of artificial intelligence (AI). This “Nuclear Renaissance” is more than a trend; it’s a paradigm shift. By leveraging advanced nuclear technologies like Small Modular Reactors (SMRs) and Advanced Modular Reactors (AMRs), countries and companies alike are addressing two major challenges: the global push for clean energy and the skyrocketing energy needs of AI-driven industries.

Nuclear power isn’t just making a comeback—it’s reshaping the energy market. And it’s offering us enormous opportunities to profit from the future of clean energy…

Why This Matters to You

The AI Revolution Needs Energy

Data centers, edge computing, and other AI applications are driving unprecedented energy demands. Traditional energy sources like coal, natural gas, and even renewables face challenges in scaling to meet this need reliably. Nuclear power, with its unmatched reliability and density, stands out as the most viable solution.

The Nuclear Renaissance Is Investable

This isn’t just about policy shifts or scientific breakthroughs. It’s about dollars and cents. Public companies leading in SMR and AMR technologies are poised to benefit massively from the nuclear resurgence. These stocks represent real opportunities for investors who act early.

Meet the Leaders of the Nuclear Renaissance

Here are the key players in the U.S. and global nuclear sectors driving innovation and investment opportunities:

Publicly Traded U.S. Companies

- Centrus Energy Corp (NYSE: LEU): The only U.S. company licensed to produce High-Assay Low-Enriched Uranium (HALEU), a critical fuel for next-gen reactors. Its Ohio facility is already operational.

- NuScale Power (NYSE: SMR): Developed the first SMR design to receive U.S. regulatory approval, offering scalable, cost-efficient solutions for utilities and tech companies alike.

Global Innovators

- Rolls-Royce Holdings (LSE: RR): Developing SMRs to transform the energy market in the UK.

- General Electric (NYSE: GE): Innovating in SMR technology through its GE Hitachi Nuclear Energy division.

- Westinghouse Electric (Brookfield Renewable Partners, NYSE: BEP): Pioneering SMR designs while supporting large-scale nuclear operations.

Note: Companies like X-energy are significant private innovators in the sector, but their equity is not currently available to public investors.

The AI-Nuclear Connection

Why Nuclear Energy Is Key for AI

AI-driven industries, from machine learning to autonomous systems, demand vast amounts of energy. Companies like Microsoft (MSFT), Google (GOOGL), and Amazon (AMZN) are already investing in nuclear to power their AI infrastructure:

- Microsoft: Partnered with Constellation Energy to restart the Three Mile Island Unit 1 reactor.

- Google: Secured power agreements from Kairos Power’s SMRs to fuel its operations.

- Amazon: Launched projects to deploy SMRs across its facilities.

What This Means for Investors

These tech giants are leading the charge, but they can’t do it alone. The companies developing SMRs and AMRs will supply the tech and fuel to make these projects a reality. Their success translates directly into shareholder value.

Why SMRs and AMRs Are Game-Changers

Modern nuclear technologies like SMRs and AMRs represent a leap forward from traditional reactors.

Advantages for Investors:

- Scalability: Smaller reactors mean faster deployment and adaptability to market demand.

- Cost Efficiency: Modular construction significantly lowers upfront costs compared to traditional reactors.

- Enhanced Safety: Passive safety features minimize the risk of catastrophic failure, increasing public and governmental support.

- Diverse Applications: Beyond electricity, these reactors can produce industrial heat, desalinate water, and support hydrogen production.

These innovations make nuclear an attractive energy source for governments, corporations, and investors alike.

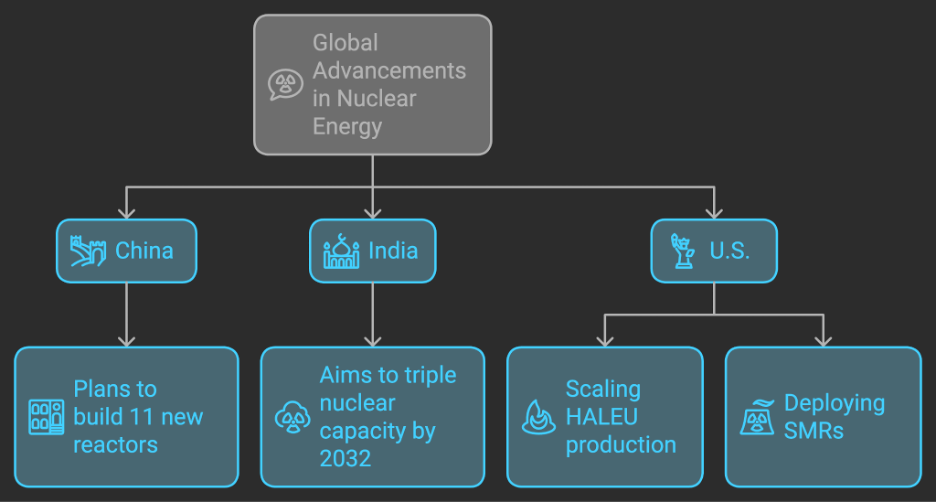

Nuclear energy’s potential is catching on worldwide:

- China: Plans to build 11 new reactors within five years, expanding its leadership in nuclear technology.

- India: Aims to triple nuclear capacity by 2032 as part of its economic growth strategy.

- U.S.: Scaling HALEU production and deploying SMRs to revitalize its nuclear sector.

At COP28, 25 countries committed to tripling global nuclear capacity by 2050, supported by the International Atomic Energy Agency (IAEA). For investors, this global momentum creates a fertile ground for long-term opportunities.

What’s Next?

For investors, the Nuclear Renaissance represents a unique chance to get ahead of the curve. As AI continues to reshape industries and global energy demands grow, nuclear power is positioned to take center stage.

How to Play the Trend:

- Track Companies Driving Innovation: Focus on players like Centrus Energy (LEU) and NuScale Power (SMR).

- Watch for Policy Tailwinds: Nuclear-friendly policies, such as U.S. and UK incentives for SMRs, can provide additional upside.

- Look for Tech-Nuclear Partnerships: Deals like Microsoft and Constellation Energy signal growing adoption of nuclear by tech giants.

Final Thought: A Renaissance in the Making

The nuclear renaissance isn’t just about clean energy—it’s about powering the technologies of tomorrow. By understanding the companies and innovations leading this transformation, investors can position themselves for potential gains in this rapidly evolving sector.

Want to learn more about investing in the energy revolution?

Join Jonathan Rose LIVE every morning for in-depth analysis, actionable recommendations, and updates on the companies shaping the future of clean energy.

Let’s power your portfolio with the Nuclear Renaissance.

Thanks for reading,

Jonathan Rose