The best traders move fast before the markets even have a clue. It’s one of the most important lessons I’ve learned over decades trading options.

But today’s market is making us cautious to a fault.

I’m seeing so many buy-and-hold traders scared stiff.

While it’s only June, I believe that 2025 will go down as one of the most volatile years the stock market has ever seen.

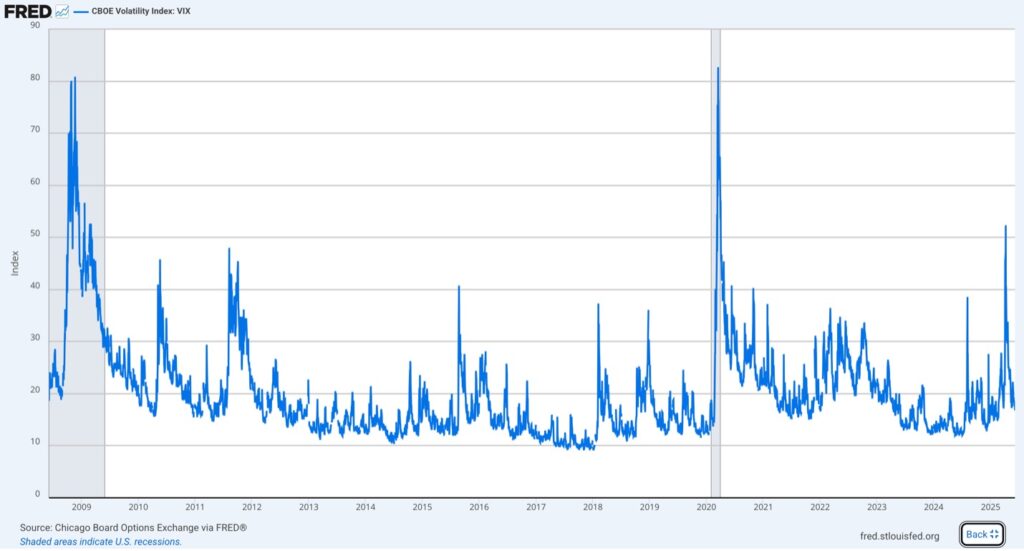

Just take a look at this VIX chart.

Here’s a simple rule of thumb…

When the VIX spikes, markets are in panic mode. When it drops, investors breathe easier.

As we can see, this year has driven the VIX close to levels we’ve only seen during the worst market crises in history.

Since 2008, the VIX has only climbed this high twice: during the 2020 Pandemic and the 2008 Financial Crisis.

April’s big shock may not seem as bad as those two moves. But we’re not out of the woods just yet.

The S&P 500 and Dow Jones are only now peeking their heads back in positive territory for 2025.

And even bellwether domestic stocks from Apple to Nvidia are rolling off their highs as I write to you.

Simply put, this isn’t a market for the faint-hearted.

But even if volatility isn’t going anywhere fast…

For nimble traders, it’s creating perfect trading opportunities – as long as we know where to find them.

I subscribe to one golden rule…

When the markets hand you volatility, you trade volatility.

It’s a key lesson I’ve learned well over nearly 30 years trading options and making markets for the biggest players in the game.

But I only truly understood the power of that statement the day I launched a little experiment that changed the whole game for me.

The Options Market Plays Hiding in Plain Sight

Around 2015, I tried a little experiment to leverage my one-of-a-kind knowledge…

I developed a software tool around a key market indicator.

It’s a tool that tips us off to the biggest trades changing hands in the options market before most have any idea of what’s going on.

I call it the Unusual Options Activity (UOA) Scanner. And it has seriously changed the game for my readers…

Back around late 2015, when I was initially testing this indicator, something big caught my eye.

Someone had just bought roughly $9 million in put options in a company called Sempra Energy.

Now that’s a massive trade when you consider the stock usually sees under a million dollars in daily options volume.

Clearly, someone was anticipating a volatile downturn in the stock.

So I dug deeper. That’s when I found out Sempra Energy was a holding company owning several subsidiaries. And one of them was Southern California Gas Company.

Here’s the kicker…

Southern California Gas had recently experienced one of the worst gas leaks ever recorded in U.S. history. The media was even comparing it to the infamous BP oil spill.

Yet no outlets had linked Southern California Gas Company to Sempra.

But it looked like someone on Wall Street had connected the dots and was aggressively betting against the stock.

Realizing the opportunity, I quickly alerted a handful of my subscribers to grab the $80 put options at $4.00 – or just $400 per contract. That was our maximum risk on the trade.

And sure enough, a few days later, California officially declared a state of emergency. Headlines finally began linking the crisis to Sempra Energy.

Here’s how the stock reacted…

Shares plummeted about 8% in just one day. Now that would be a very bad trade for anyone just buying pure stock or making a bullish option play.

But those put options handed us profits. They soared more than 2,000% over the next 17 days…

That’s not an isolated incident.

In fact, I’ve managed many successful trade setups like these. And they’re all designed to find big moves just like Sempra’s well before the market even has a clue.

Back in April – when volatility sparked one of the worst market-wide sell-offs in history – I got another crazy idea.

I spotted the perfect volatility play… A widening gap between Mexican and Brazilian stocks driven by tariff-war pressure.

I saw the chance to benefit from a key divergence forming between two major markets.

So I told my readers to double down on calls on one ETF and puts on the other. And we made out with triple-digit gains in mere days.

That triple-digit gain wasn’t mere luck… It came from spotting an opportunity that simply wasn’t on many traders’ radars.

And we’ve seen even more since then…

On March 18th, I tipped off my Advanced Notice readers to a massive inflow of calls into Alignment Healthcare (ALHC).

My UOA scanner detected a $1.1 million trade on this $3 billion small-cap that simply wasn’t on many trader’s radar.

I figured anyone risking $1.1 million on an under-the-radar small cap likely knows something we don’t…

So we followed the smart money and tranched into this trade up to 3x.

After holding the position for less than a month, we exited one of our call positions for a stunning, near-200% gain.

Those are just a few key examples of stocks that have absolutely thrived during periods of heightened volatility.

The truth is, the markets are constantly flashing opportunities like these. But for most traders, it’s nearly impossible to get in on them.

I’m here to make one thing clear… Those opportunities aren’t just reserved for the elite. And I want to give you the edge to find them using the kind of data major institutional players use all the time.

A New Edge in a Volatile Market

Now, knowing when and where to look for these opportunities has typically been the domain of market-makers, institutional traders, and other smart money players.

They have all the leverage and the funny money to play around with.

But when a potential crisis sends the markets in every direction, regular folks shouldn’t sit on the sidelines while the smart money reaps all the benefits.

Those gains I showed you above aren’t just once-in-market cycle opportunities. The markets are handing us more trades like these as I write to you.

I’ll give you some perspective…

Right now, our key volatility indicators – like the VIX I showed you earlier – are still flashing warning signals.

If you know how to track real market flow — not the headlines, but the footprints that institutional players leave behind — it’s possible to find trades with huge upside even in this kind of chaos.

That’s exactly what I focus on inside Advanced Notice.

Every day, I track Unusual Options Activity — where big money is moving before the market catches up. It’s one of the most powerful indicators I’ve ever used in my career. Especially when volatility spikes, UOA often shows us where the real action is happening.

With this special presentation, I want to show novice and pro traders alike how to discover those big money trades hiding in plain sight. It’s one of the most lucrative strategies out there – and it’s all available to any readers looking to unlock a whole new edge in their portfolios.

Remember, the creative trader wins,

Jonathan Rose