My headache got so bad I ended up in the emergency room at Northwestern Memorial Hospital.

That’s where a doctor plunged a needle into my spine…

I was 33 years old. And I was a director of trading at a leading “prop” trading firm in Chicago.

Instead of managing money for clients, we traded with our own money. My job was to manage the risk for the firm… with dozens of traders under my supervision.

This was 2008. And we were facing a loss on one of our trades that could cripple our firm.

I was in good health. I had plenty of experience handling risk. But I had a bad feeling about this trade – and a blinding headache to go with it.

So, I went to my doctor. She sent me to the hospital for a spinal tap. It’s what you do if you’re worried someone has meningitis, a brain bleed, or another severe neurological issue.

Luckily, the test revealed no serious medical condition – just extreme stress.

At that time, our firm had $32 million in capital. And we had one oil trade on our books that put $15 million of that capital at risk.

To make matters worse, there was little I could do to mitigate that risk.

The trader who had placed it was the majority owner of the firm. And it was his $15 million on the line. He didn’t want to hear concerns about his trade from a 33-year-old with a stress headache.

In the end, the trade went sour. Our firm’s capital shrank from $32 million to $18 million.

It was a huge blow. But we dug our way out of that hole. And two years later, we sold the firm to a billion-dollar hedge fund.

That near-death experience taught me a lesson I’ll never forget: As a trader, your goal is to survive first and make money second.

That’s especially crucial when all hell breaks loose – like in 2008… or during the market’s recent tariff tantrum.

This year, the S&P 500 dropped about 19% before recovering to new highs again. If you don’t know what you’re doing, that kind of whipsawing market can be scary.

But as I’ll show you today, there’s a trading strategy you can use that’s perfect for choppy markets – whether bull or bear.

It may sound weird. But you need to stop making binary bets on the direction of stocks – also known as coin flips – and trade the relationships between stocks instead.

I call it divergence trading because you’re looking for moments when stocks that usually move in line suddenly diverge. Then you place trades that profit when they come back in line again.

And I’ve used this strategy to hand my subscribers triple-digit gains including…

- 122% in 35 days

- 127% in 5 days

- 142% in 39 days

- 322% in 32 days

- 411% in 39 days

- 752% in 40 days

- 805% in 70 days

- And 967% in 52 days

I’ve just released a special briefing all about this strategy… and about a major divergence trade that’s opening up right now.

Watch it here for free. Then read on below for more on how divergence trades work and how I used them to make millions for my personal account – including during some of the worst markets in living memory.

First, a quick introduction.

Winner’s Mindset

Over my nearly three decades as a professional trader, I’ve tested countless strategies.

In 1997, I got my start as a floor trader at the Chicago Mercantile Exchange (CME).

This was back in the day of open outcry pits. If you’ve seen the 1983 Eddie Murphy movie Trading Places, you’ll recognize the shouting and frantic hand signals we used to execute trades.

Then, in 2003, a group of top Chicago traders asked me to join their new prop trading firm. I was employee No. 6. By the time we sold the firm seven years later to a billion-dollar hedge fund, I was one of the four partners.

I was on top of my game. But I felt it was time for a break.

So, I took a year off to train for the Ironman Wisconsin triathlon. I pushed myself to new heights every day – ultimately achieving my long-time goal of completing the race.

I swam 2.4 miles in Lake Monona, biked 112 miles over city roads and rural highways, and then ran a 26.2-mile marathon through downtown Madison –140.6 grueling miles in total.

Completing the Ironman was one of my proudest personal accomplishments. It taught me that, with enough dedication and hard work, I could achieve anything.

With this winner’s mindset, in 2011, I rented a seat on the floor of the Chicago Board Options Exchange (CBOE). I became a market maker at the largest options exchange in the world.

I bought and sold stocks to keep markets efficient. And I profited off the gap – or “spread” – between the buy and sell price.

But it wasn’t until 2015 that I found my true passion – teaching regular folks how to trade like the pros.

That’s when I launched my Masters in Trading trader education and advisory business.

I recommend trades to subscribers. I also run a thriving online community of apprentice traders who support each other, share their progress, and chat with me in real time.

And we trade differently from what most amateur traders are used to.

Forget Binary Bets – It’s All About Relationships

Picture a wolf pack on the hunt for prey.

It’s one of nature’s most coordinated forces. The wolves travel in formation – not for show, but for survival.

Each wolf has a role. Scouts up front, strong males on the flanks, the alpha pair directing pace and direction. Even the stragglers at the rear play a purpose. They watch for threats and keep the pack tight.

But sometimes, one wolf diverges from the pack.

Maybe it sees or smells something. And it moves ahead of the pack to investigate.

But that break in formation doesn’t last long – 99 times out of 100, that wolf drifts back to the pack.

That’s exactly how I view the market.

I don’t make binary bets on whether a stock will go up or down like most rookie traders do.

Instead, I look for relationships between stocks that usually move together – but occasionally break apart. Then I bet on those relationships coming back into line.

This reframe – from guessing direction to tracking relationships – has been the foundation of my success since I got my start on the floor of the CME.

In fact, one of my first big wins came when I spotted something unusual during the Nasdaq’s digital transformation…

…a regular divergence between prices quoted on the trading floor and the prices quoted on the new electronic system.

That launched my career. And trading divergences like this has helped me make a lot of money as a trader over the years.

We’re talking more than $800,000 in 2006… $2.3 million in 2007… and $4 million in 2008 – during the worst meltdown for stocks since the Great Depression.

I’m not trying to predict the future….

I’m not staring at candlestick charts or memorizing Fibonacci patterns…

And I’m not chasing the latest “hot stock” making headlines.

All I need to do is spot when two related assets get pulled apart… and position myself to profit when they come back together.

Let me show you what I mean with some real-world examples.

It Doesn’t Take a Genius to Spot These Divergences

This first chart is of two e-commerce giants – Amazon.com (AMZN) and Alibaba (BABA).

Normally, these two stocks move in line. But sometimes they diverge (red circles). Then those divergences come back in line again (green crosses).

And here’s another classic pair of stocks that typically trades in line but sometimes diverges – rideshare rivals Uber (UBER) and Lyft (LYFT).

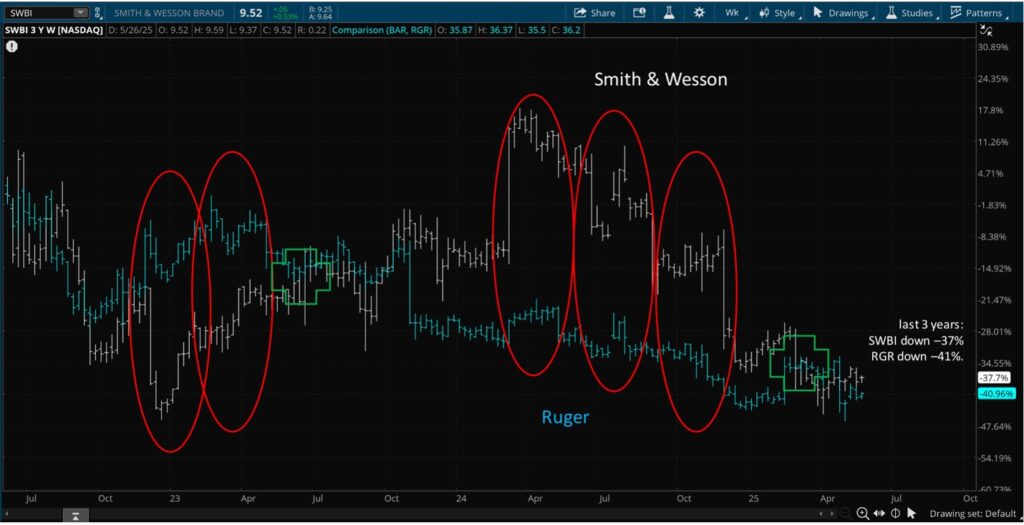

And here are gunmakers Smith & Wesson (SWBI) and Sturm, Ruger & Company (RGR).

I told you it doesn’t take a genius to figure out these trades. You just have to see when the two lines are breaking apart and bet on them coming together again.

And these divergences are nothing compared with the one that’s setting up in the market right now.

It has the potential to deliver thousands of dollars in profits without taking crazy risks with your money.

Just ask one of my followers, Dan B…

The last time this same divergence happened he took a single position and walked away with a game-changing result. As he later wrote me…

My account went from $44,325 to over $180,000 – on a single trade.

I don’t have the time or space here to get into all the details.

I get into a ton more detail about how you can use these trades to speed up your wealth building journey… and avoid the wealth destroying mistakes so many rookie traders make.

Remember, the creative trader always wins!

Jonathan Rose,

Founder, Masters in Trading

P.S. I hope you’ll check out my new divergence trading presentation. It distills my nearly 30 years of experience as a professional trader into one short video.

And over at Masters in Trading LIVE, I’ve been putting together a whole series of videos aimed at showing you the fundamentals of trading divergences in the stock market.

This video I recorded on Wednesday is all about my powerful divergence strategy — and I’ve got a couple more I’m rolling out over the next few days. So make sure to tune in!